Table of Contents

Understand to Implement Wire Static Payoff in Your Business Operations

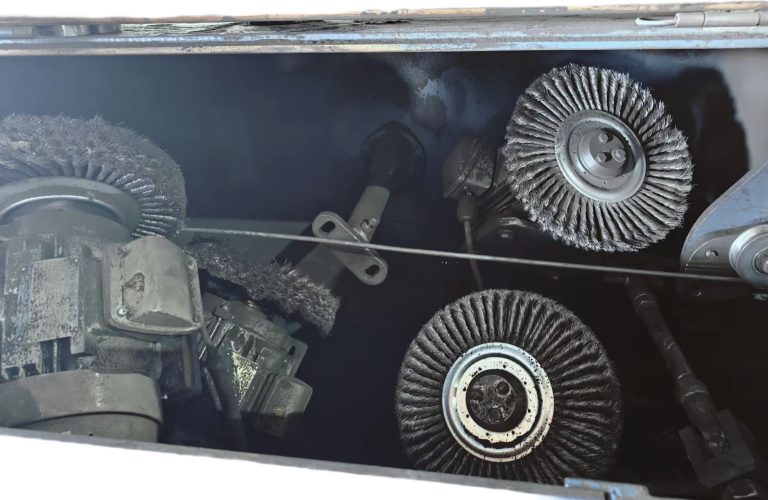

Wire static payoff is a concept that can greatly benefit businesses looking to streamline their operations and improve efficiency. By implementing wire static payoff, companies can reduce the time and effort required to process payments, ultimately saving money and increasing productivity. In this article, we will discuss how Vertical Payoff For Wire Drawing Machine works and how you can implement it in your business operations.

Wire static payoff is a method of automatically paying off outstanding balances on a regular basis, typically on a daily or weekly schedule. This can be done through an automated system that connects to your company’s bank account and automatically transfers funds to pay off any outstanding invoices or bills. By setting up wire static payoff, businesses can ensure that their accounts are always up to date and that they are not accruing unnecessary interest or late fees.

One of the key benefits of wire static payoff is that it eliminates the need for manual intervention in the payment process. Instead of having to manually review and approve each payment, businesses can set up rules and parameters for the automated system to follow. This not only saves time and effort but also reduces the risk of human error in the payment process.

Another advantage of wire static payoff is that it can help businesses better manage their cash flow. By automatically paying off outstanding balances on a regular basis, companies can ensure that they are always up to date on their financial obligations. This can help prevent cash flow problems and ensure that the business has the funds it needs to operate smoothly.

To implement wire Flipper Pay-Off Horizontal in your business operations, you will first need to set up an automated payment system. This system should be able to connect to your company’s bank account and have the ability to transfer funds on a regular schedule. You will also need to establish rules and parameters for the system to follow, such as which invoices or bills to pay off and how much to transfer.

Once you have set up the automated payment system, you will need to monitor it regularly to ensure that it is functioning correctly. You may need to make adjustments to the rules and parameters as needed to ensure that the system is paying off the right invoices at the right time. It is also important to review your bank statements regularly to ensure that the payments are being processed correctly and that there are no discrepancies.

In conclusion, wire static payoff is a valuable tool for businesses looking to streamline their payment processes and improve efficiency. By automating the payment of outstanding balances, companies can save time and effort, reduce the risk of human error, and better manage their cash flow. If you are interested in implementing wire static payoff in your business operations, be sure to set up an automated payment system, establish rules and parameters for the system to follow, and monitor it regularly to ensure that it is functioning correctly.

Advantages of Using Wire Static Payoff in Financial Transactions

Wire static payoff is a method of settling financial transactions that offers several advantages over traditional payment methods. In today’s fast-paced world, businesses and individuals are constantly looking for ways to streamline their financial processes and reduce the risk of errors or delays. Wire static payoff provides a secure and efficient way to transfer funds, making it an attractive option for those looking to simplify their financial transactions.

One of the key advantages of using wire Overhead Payoff is the speed at which transactions can be completed. Unlike traditional payment methods, which can take days to process, wire transfers are typically completed within hours or even minutes. This can be especially beneficial for businesses that need to make time-sensitive payments or individuals who need to transfer funds quickly.

In addition to speed, wire static payoff also offers a high level of security. Because wire transfers are conducted through a secure network, the risk of fraud or unauthorized access is significantly reduced. This can provide peace of mind for both the sender and the recipient, knowing that their funds are being transferred in a safe and secure manner.

Another advantage of using wire static payoff is the convenience it offers. With traditional payment methods, individuals often have to visit a bank or financial institution in person to initiate a transfer. With wire transfers, however, transactions can be completed online or over the phone, making it easy for individuals to send or receive funds from anywhere in the world.

Furthermore, wire static payoff is a cost-effective option for transferring funds. While some banks may charge a fee for wire transfers, these fees are often lower than the costs associated with other payment methods, such as checks or money orders. This can result in significant savings for businesses and individuals who frequently need to transfer funds.

Additionally, wire static payoff is a reliable method of settling financial transactions. Unlike checks, which can bounce or be delayed in the mail, wire transfers are guaranteed to be completed once initiated. This can help businesses and individuals avoid the risk of non-payment or insufficient funds, ensuring that transactions are completed in a timely and efficient manner.

Overall, wire static payoff offers a number of advantages for those looking to simplify their financial transactions. From its speed and security to its convenience and cost-effectiveness, wire transfers provide a reliable and efficient way to transfer funds. Whether you are a business looking to make time-sensitive payments or an individual needing to send money quickly, wire static payoff can help streamline your financial processes and provide peace of mind knowing that your funds are being transferred securely and efficiently.